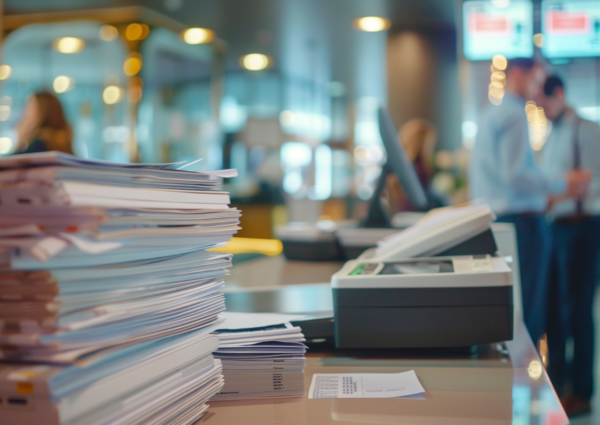

Financial Document Scanning Solutions

In the dynamic financial industry, achieving operational excellence while adhering to stringent compliance and security standards is crucial. PROSCAN's Financial Document Scanning Services empower banks, credit unions, and financial firms to transition seamlessly to digital document management. Our tailored solutions not only streamline processes but also reinforce data security and regulatory adherence, ensuring your institution remains competitive in the digital era. With PROSCAN, enhance your document management strategy, enhancing efficiency and safeguarding your valuable data with precision and reliability.

Financial document scanning is essential for enhancing operational efficiency, ensuring compliance with stringent regulatory requirements, improving data security, and providing better customer service through quicker document access and processing.

We implement advanced encryption, secure data storage, and strict access controls to protect sensitive information, adhering to the highest standards of data protection and regulatory compliance in the financial industry.

Yes, our solutions are designed for seamless integration with your institution's existing document management systems, CRMs, and operational software, ensuring a smooth transition and minimal disruption to your workflows.

We can scan a wide array of financial documents, including loan agreements, investment portfolios, client records, compliance documents, and any other paper-based records requiring digitization.

Digitized documents are easier to manage, track, and retrieve, facilitating adherence to regulatory standards and simplifying the audit process, thereby improving compliance and reducing the risk of penalties.

Our deep expertise in financial documents, customized solutions tailored to specific institutional needs, cutting-edge technology, and exceptional customer service set us apart in the financial document management industry.

The timeline varies depending on the volume and condition of documents, but we strive for efficiency without compromising quality, aiming to complete most projects within a few weeks.

Absolutely, we provide continuous support, maintenance, and training to ensure your document management system remains effective, secure, and compliant over time.

Our digital document management solutions offer robust disaster recovery capabilities, ensuring critical financial records are secure, backed up, and accessible in the event of a physical disaster.

Yes, our services are scalable and customizable to meet the needs of any size financial institution, from small credit unions to large banking conglomerates.

Digitization allows for faster retrieval and processing of client documents, reducing wait times, improving accuracy, and enabling better overall customer service.

Post-scanning, clients can choose to have their original documents securely returned, stored, or properly disposed of through shredding, based on their preferences and regulatory requirements.

Yes, our advanced scanning technology and expert technicians are equipped to handle and digitize documents in various conditions, restoring them as much as possible during the digitization process.

Costs vary based on project scope, including document volume and specific requirements. We provide transparent, customized quotes to fit your institution’s needs and budget.

Getting started is easy. Contact us through our website or by phone for a consultation. We'll discuss your needs, provide a detailed quote, and outline the steps to begin your project.